How to Use Trading Signals for Spot Trading Success

Cryptocurrency trading has become increasingly popular in recent years, with many investors seeking to capitalize on the fluctuations in Bitcoin and other digital currencies. While spot trading can be lucrative, it requires a solid understanding of the markets and effective risk management strategies. One key aspect of successful spot trading is using trading signals to make informed decisions.

What are Trading Signals?

Trading signals refer to pre-defined indicators or patterns that indicate when to enter or exit a trade. These signals can be based on various factors, including technical analysis, chart patterns, news events, and market sentiment. By analyzing these signals, traders can gain an edge over the market and reduce their risk exposure.

Types of Trading Signals

There are several types of trading signals that traders use:

- Technical indicators: These are mathematical formulas that analyze various price movements and patterns on charts.

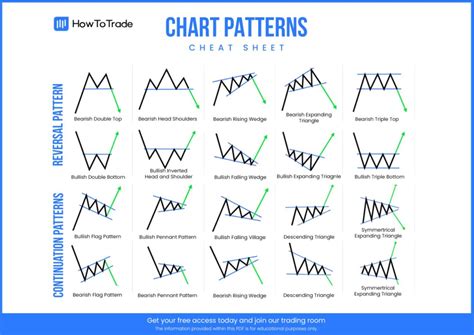

- Chart patterns

: These are specific shapes or combinations of shapes on a chart that indicate potential buying or selling opportunities.

- News events: Traders may use news events, such as regulatory changes or economic announcements, to trigger trading signals.

- Sentiment analysis: This involves analyzing market sentiment using tools like Aroon and CMC Markets.

How to Use Trading Signals for Spot Trading Success

Here are some tips for using trading signals effectively in spot trading:

- Choose a reliable signal provider: Select a reputable signal provider with a track record of producing accurate signals.

- Set up multiple signals: Consider setting up multiple signals to confirm the strength and reliability of your signals.

- Use a combination of indicators: Combine technical and chart-based signals to gain a more comprehensive understanding of market conditions.

- Stay disciplined: Stick to your trading plan and avoid impulsive decisions based on emotional factors.

- Monitor and adjust: Continuously monitor your signal’s performance and adjust your strategy as needed.

Popular Trading Signal Providers

Some popular trading signal providers include:

- Coinigy: Offers a range of technical indicators and chart patterns for cryptocurrency trading.

- TradingView: Provides an extensive library of technical indicators, chart patterns, and news feeds.

- Gekko: Offers a range of technical indicators and signal generation tools for cryptocurrency trading.

- Intrinio: Provides financial data and analytics for traders to help identify potential trading opportunities.

Benefits of Using Trading Signals

Using trading signals can provide several benefits, including:

- Increased accuracy: By relying on pre-defined indicators, traders can reduce the risk of incorrect signal generation.

- Improved discipline: Sticking to a trading plan and monitoring signal performance helps maintain emotional control in the face of market volatility.

- Enhanced decision-making: Trading signals can help traders identify potential buying or selling opportunities based on clear, objective criteria.

Conclusion

Using trading signals is an effective way for spot traders to gain an edge over the market and reduce risk exposure. By following these tips and choosing a reliable signal provider, traders can improve their chances of success in the cryptocurrency market. Remember to stay disciplined, monitor your strategy, and adjust as needed to maintain optimal results.

Additional Resources

For more information on trading signals and spot trading strategies, consider the following resources:

- TradingView: A comprehensive online platform for traders to analyze charts, generate indicators, and share ideas.